A&A Global Industries, an Acacia Partners Portfolio Company, is Actively Seeking Add-On Opportunities in the Amusement & Entertainment Products Sector

A&A Global Industries (https://www.aaglobal.com/), an Acacia Partners portfolio company, is actively seeking add-on opportunities. An ideal target would distribute products sold in Family Entertainment Centers, Amusement Parks, Museums, Zoo’s and retail. A&A is a flexible buyer with a focus on the below criteria.

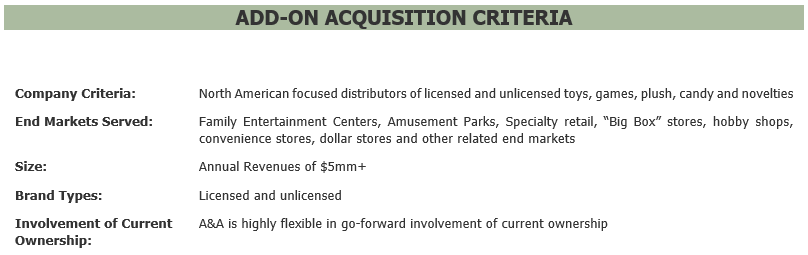

Add On Criteria:

- Company Criteria: North American focused distributors of licensed and unlicensed toys, games, plush, candy and novelties

- End Markets Served: Family Entertainment Centers, Amusement Parks, Specialty retail, “Big Box” stores, hobby shops, convenience stores, dollar stores and other related end markets

- Size: Annual Revenues of $5mm+

- Brand Types: Licensed and unlicensed

- Involvement of Current Ownership: A&A is highly flexible in go-forward involvement of current ownership

About A&A Global Industries:

A&A Global Industries Inc. (“A&A”) is a premier nationwide value-added distributor of toys, candy, plush (stuffed animals) and redemption products to family entertainment centers (“FEC”), vending route operators, and amusement companies. Koko’s Confectionary and Novelty, A&A’s novelty candy division, sells candy jewelry, squeeze candy, and other novelties. Its product portfolio consists of desirable brands and licenses and can be found in many end-markets including grocery, convenience, and candy stores as well as FECs. Headquartered in Baltimore, Maryland, A&A is known for its innovative product offering, comprehensive safety testing and ease of doing business.

About Acacia Partners:

Acacia Partners is a private investment firm based in Austin, Texas that invests only in family-owned and owner-operated companies. Acacia invests from a committed capital fund in businesses ranging in enterprise value from $50 million to $300 million that are seeking majority or minority equity investment partners. Unlike traditional private equity firms, Acacia has a high degree of flexibility regarding investment structure and time horizon.